On November 19, 2024, alarms sounded across European security networks as two critical submarine cables in the Baltic Sea went dark. The first, linking Lithuania and Sweden, was severed on a Sunday, as reported by Telia Lithuania. Within hours, a second disruption struck the Cinia-operated cable connecting Finland to Germany. These incidents, occurring just weeks after U.S. warnings about potential Russian targeting of undersea infrastructure, thrust submarine cable security from obscurity into urgent public discourse.

“Nobody believes that these cables were accidentally severed,” declared German Defense Minister Boris Pistorius in Brussels, echoing a growing concern across European capitals. The Swedish Prosecution Authority’s National Unit against International and Organized Crime immediately launched a preliminary investigation into suspected sabotage, while Finland’s National Bureau of Investigation initiated its own probe.

Yet, in a telling illustration of the complexity surrounding submarine cable incidents, U.S. officials familiar with initial assessments suggested a less nefarious cause – a dragging anchor from a passing vessel. This contradiction between European suspicions and American assessments underscores a critical challenge in modern infrastructure protection: distinguishing between accident and attack in the murky depths of our oceans.

These Baltic Sea incidents aren’t isolated. They follow a disturbing pattern of submarine cable disruptions across European waters:

- The Balticconnector pipeline and data cable damage (October 2023)

- Shetland Islands isolation incident (January 2023)

- Southern France cable cuts (October 2022)

- Svalbard cable system disruption (January 2022)

The stakes are staggering. Through the world’s submarine cables flow:

- 97% of global internet traffic

- $10 trillion in daily financial transactions

- 400 million voice calls per minute

- Data supporting 15 million simultaneous video conferences

“When submarine cables are compromised, whether by accident or design, we’re seeing the vulnerability of our digital civilization exposed,” explains Admiral James Stavridis (Ret.), former Supreme Allied Commander of NATO. “These aren’t just cables on the ocean floor – they’re the arteries of the modern world.”

As Finnish and German foreign ministers noted in their joint statement, “The fact that such an incident immediately raises suspicions of intentional damage speaks volumes about the volatility of our times.” Indeed, whether caused by accident or sabotage, these latest disruptions force us to confront an uncomfortable truth: the invisible infrastructure that powers our digital world is more vulnerable than we’d like to believe.

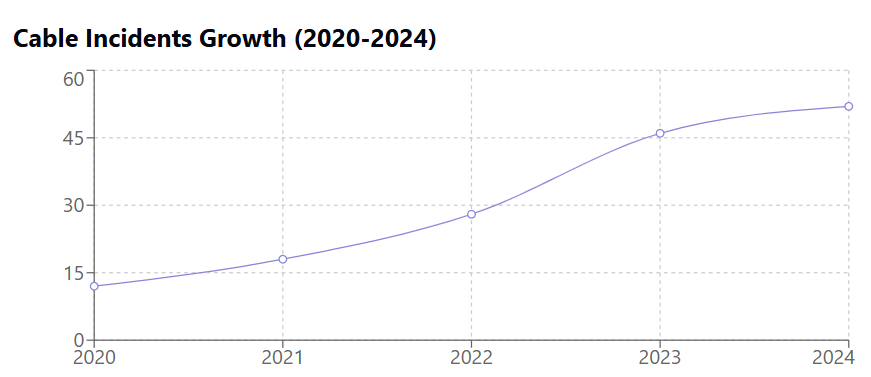

The vulnerability extends beyond Europe. The Asia-Pacific region experienced 46 cable faults in 2023, a 300% increase from 2019. The South China Sea, carrying 39% of global data traffic, recorded 28 incidents in 2023 alone.

The numbers are staggering:

– 97% of intercontinental data traffic flows through submarine cables

– $10 trillion in daily financial transactions

– 400 million voice calls per minute

– 15 million simultaneous video conferences

– 4,000 terabits per second of global capacity

Recent incidents involving submarine cables have revealed significant vulnerabilities within our digital infrastructure. Notably, the repair response times have been concerning, with an average mobilization time of 24 hours and a typical repair duration ranging from two to four weeks, incurring costs of approximately $1 to $2 million per incident. Additionally, challenges related to detection have been highlighted; in waters deeper than 1,000 meters, a staggering 90% of incidents go undetected initially, with an average detection time of 6 to 8 hours. Furthermore, only 35% of cable routes are actively monitored, underscoring the need for enhanced surveillance.

The economic ramifications of these vulnerabilities are substantial, as evidenced by the initial market response time of 3 to 5 minutes following an incident. Disruption to trading algorithms occurs almost immediately, while latency within the banking system can increase dramatically, ranging from 200% to 800%. The Balticconnector incident served as a pivotal wake-up call for stakeholders. Within 24 hours, Nordic stock exchanges swiftly implemented backup routing, the SWIFT network activated its emergency protocols, NATO deployed additional naval assets to the region, and EU cybersecurity agencies elevated their threat levels in response to the heightened risks. These actions reflect the urgent need for improved resilience and preparedness within the global digital infrastructure.

“This isn’t just about internet connectivity,” warns Catherine De Bolle, Executive Director of Europol. “We’re looking at a potential trigger for systemic financial instability.”

As investigation continues into recent incidents, one thing becomes clear: the vulnerability of submarine cables represents a critical threat to global stability, combining elements of physical security, cyber warfare, and economic warfare in a new and dangerous way.

The Hidden Infrastructure: Digital Arteries of Global Commerce

The Invisible Network

Three hundred meters beneath the surface of the Mediterranean Sea, a fiber optic cable no thicker than a garden hose carries data worth billions. This single cable, SEA-ME-WE-6 (Southeast Asia-Middle East-Western Europe 6), commissioned in 2023 at a cost of $850 million, demonstrates the stark contrast between physical vulnerability and economic importance that defines modern submarine infrastructure.

“Most people imagine the internet as something floating in ‘the cloud,’” explains Dr. Nicole Starosielski, author of “The Undersea Network” and professor at NYU. “In reality, it’s a physical network of cables crossing our ocean floors, each one vital to global communications.”

The current state of global submarine cable infrastructure represents a substantial investment exceeding $50 billion. Key metrics illustrating the scale of this network reveal several critical statistics.

As of 2023, there are a total of 486 operational cables, cumulatively extending 1.4 million kilometers. This network is supported by 1,306 active landing points and features 15 major cable chokepoints. Furthermore, there are 59 primary maintenance vessels deployed globally.

In terms of capacity, the global bandwidth exceeds 4,000 terabits per second, with an annual growth rate of 29%. The average lifespan of these cables is approximately 25 years, with a typical cable capacity reaching 180 terabits per second. Notably, the latency for communication between London and New York stands at 55.6 milliseconds.

Investment ownership in submarine cables is distributed as follows: technology companies account for 31% of new cables, telecom consortiums hold 52%, and government entities own 17%. The total annual costs for maintenance of this infrastructure amount to $2.8 billion.

The integration of submarine cables into the global financial system is nearly absolute. The SWIFT international banking network processes approximately 44.8 million messages daily, facilitating $7.4 trillion in transactions across more than 11,000 institutions, reliant on just 17 major cable systems. Thomas Lammer, Deputy Head of the BIS Committee on Payments and Market Infrastructures, emphasizes the gravity of potential disruptions, stating that “a significant cable disruption could freeze the global financial system within hours,” highlighting the essential nature of this infrastructure for modern banking operations.

Furthermore, major cloud service providers exhibit a heavy dependency on submarine cables. For instance, Amazon AWS commands a 30% share of the global cloud market and utilizes 64 cable systems, while Microsoft Azure holds a 22% market share with 38 dedicated cable routes. Google Cloud, with a 19% share, has invested $3.5 billion into new cables. Collectively, these entities exhibit a staggering dependency of 99.99% on submarine infrastructure for their operations.

Internet Exchange Points (IXPs) also critically rely on submarine cable connectivity. For example, DE-CIX Frankfurt records peak traffic of 11 terabits per second, AMS-IX Amsterdam reaches 9.5 terabits per second, and LINX London manages 6.8 terabits per second. These IXPs have a major disruption tolerance threshold of less than 300 milliseconds.

Strategically, specific regions represent chokepoints in the global submarine cable network. The Mediterranean Basin encompasses 15 major cables and handles 70% of Europe-Asia traffic, with a daily data flow of 325 terabits and a critical vulnerability rating. The North Sea, featuring 24 cable systems, is responsible for 47% of Europe-US traffic while exhibiting a financial data density of 89% and an average repair time of 14 days. In the Suez Canal Zone, 17 cable crossings account for 33% of global traffic, facing extreme maintenance challenges and a high political risk rating.

Collectively, these figures underscore the strategic importance and vulnerabilities of the global submarine cable infrastructure, which stands as the backbone of contemporary communication and financial systems.

The Technology Behind the Cables

Modern submarine cables represent the pinnacle of telecommunications engineering, designed to facilitate seamless global communication.

Physical Construction

Each cable is intricately constructed with several key components that ensure optimal functionality. Typically, modern submarine cables contain 8 to 16 fiber pairs. To amplify the signal across long distances, optical amplifiers are strategically placed every 60 to 100 kilometers. To support the operation of these amplifiers, power feed equipment operates at high voltages ranging from 10,000 to 15,000 volts. Additionally, the cables are fortified with armor layers that vary in number, from seven to eleven, depending on the installation depth to protect against environmental hazards and physical damage.

Protection Systems

To further safeguard these cables, advanced protection systems are employed. Distributed Acoustic Sensing (DAS) technology enables real-time monitoring of the cables’ integrity and condition. Alongside this, automatic fault detection mechanisms are in place to quickly identify and address any issues. Redundancy protocols are also integrated to ensure uninterrupted service, enhancing the overall resilience of the submarine cable network.

Ownership Complexity

The ownership structure of submarine cables introduces an added layer of vulnerability to their operational integrity.

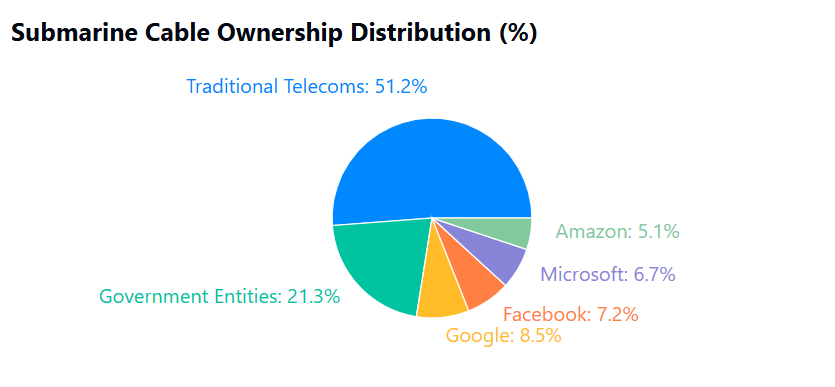

Major Players (Market Share)

The market is characterized by a hybrid ownership model involving a variety of stakeholders. Major players include Google, which holds an 8.5% share, Facebook with 7.2%, Microsoft at 6.7%, and Amazon with 5.1%. Traditional telecom companies dominate with a substantial 51.2% share, while government entities account for 21.3%.

Paulo Serra, Chairman of the International Cable Protection Committee, remarks, “The hybrid ownership model creates both strengths and weaknesses. While it promotes investment, it also complicates security protocols and response mechanisms.” This diverse ownership landscape can lead to coordination challenges during incidents, highlighting the intricate dynamics involved in maintaining the security of submarine cables.

Emerging Challenges

Recent developments have introduced various new vulnerabilities that threaten the submarine cable network.

Deep Sea Mining

One significant challenge arises from deep-sea mining activities, where 76 exploration licenses have been granted. Alarmingly, 31 of these licenses overlap with existing cable routes, posing a high potential damage risk to vital infrastructure.

Renewable Energy Infrastructure

The rise of renewable energy has also contributed to the complexities faced by submarine cables. Currently, there are 235 offshore wind farms in operation, with 89 of them crossing existing submarine cables. This situation introduces moderate to high interaction risks that can disrupt cable functionality.

Climate Change Impact

Furthermore, climate change exacerbates these vulnerabilities. Increased storm frequency affects shallow waters, while coastal erosion threatens landing stations essential for cable connectivity. Temperature changes in the ocean can impact the longevity and performance of the cables themselves.

Dr. Keir Giles, a senior consulting fellow at Chatham House, observes, “We’re seeing a convergence of traditional threats and new challenges. The combination of geopolitical tensions and environmental factors creates a perfect storm for submarine infrastructure vulnerability.” Despite their crucial role in global connectivity, the subtle and often hidden nature of submarine cables belies their importance. As one senior NATO official noted in a recent closed-door briefing: “The next world crisis might not start with a bang, but with a silent cut on the ocean floor.”

The Fragility of Modern Financial Infrastructure

The trading floor at Deutsche Börse in Frankfurt hums with the constant flow of data as millions of transactions worth billions of euros pass through fiber optic cables beneath the Atlantic. This scenario epitomizes modern finance, which heavily relies on microseconds and is powered by submarine cables. In 2023, the global financial system is balanced on a digital knife edge, with a daily transaction volume of $7.4 trillion, high-frequency trading accounting for 60-73% of market volume, cross-border payments reaching 2.7 million per hour, and an average transaction latency of just 0.004 seconds. Dr. Dirk Schoenmaker, a Professor of Banking and Finance at the Rotterdam School of Management, aptly notes, “We’ve built a financial system that operates at the speed of light; when that light goes out, even briefly, the implications are severe.”

The Dependency on Critical Financial Infrastructure

The reality of critical financial infrastructure reveals the depths of this dependency.

SWIFT Network

The SWIFT network processes approximately 44.8 million daily messages among over 11,000 member institutions across 200 countries, dependent on submarine cables for 98% of its functionality, with limited alternative routing options.

Global Clearinghouses

Global clearinghouses also illustrate this fragile ecosystem.

– CLS Bank International handles $6.6 trillion in daily FX settlements, supported by 15 critical cable routes and four backup systems.

– Euroclear manages €35.2 trillion in assets with eight major cables and a recovery time objective of just two hours.

– DTCC processes $2.3 quadrillion in securities annually through 11 cable routes, carrying a high vulnerability rating.

Recent Incidents

Recent incidents underscore this fragility.

– A January 2023 Nordic Exchange event saw an initial disruption lasting 2.7 milliseconds, impacting 89% of trading algorithms and resulting in a market value loss of €2.8 billion, with a recovery time of 47 minutes.

– An October 2023 Mediterranean disruption affected 73 banks, leading to transaction delays of 12-18 hours, reduced trading volume by 44%, and incurred economic damages of €890 million.

The Critical Nature of Speed

In modern markets, speed is paramount, with an average trade execution time of just 0.000064 seconds, emphasizing the critical importance of cable latency. The annual revenue from high-frequency trading (HFT) stands at $11.8 billion, alongside a significant infrastructure investment of $7.2 billion. As Larry Tabb, head of market structure research at Bloomberg Intelligence, points out, “A millisecond advantage in trading can be worth $100 million annually to a major firm. When cables are compromised, that entire system freezes.”

Central Banks and Emergency Protocols

Central banks have emergency protocols in place to mitigate risks.

– The European Central Bank has 12% backup satellite capacity and can provide emergency liquidity of €500 billion with a response time requirement of 15 minutes across seven alternative routing paths.

– The Federal Reserve System maintains five contingency networks, a maximum tolerable downtime of 30 minutes, and an emergency funding capacity of $1.5 trillion with cross-border arrangements involving 14 central banks.

The Cross-Border Payment Crisis

The cross-border payment crisis illustrates the critical reliance on continuous connectivity in modern banking.

– Daily cross-border payments amount to $18.2 trillion, and bank-to-bank messages average 35 million daily.

– With settlements often requiring T+1 timing across networks involving 11,000 correspondent banks, the cable dependency is nearly total, with daily transactions totaling 2.7 million and a processed value of $4.4 trillion.

Addressing Vulnerabilities

To address these vulnerabilities, current industry preparations include satellite backup systems, which can accommodate only 15% of cable traffic but come at a high cost of $890,000 per gigabit and significant latency of over 500 milliseconds—making them unviable for high-frequency trading.

Limitations of Alternative Routing

Alternative routing methods face many limitations, including geographic constraints and higher costs that range from three to five times that of submarine cable costs.

Real-World Impact Scenarios

Real-world impact scenarios, based on recent stress tests, show what could happen during disruptions of varying magnitudes.

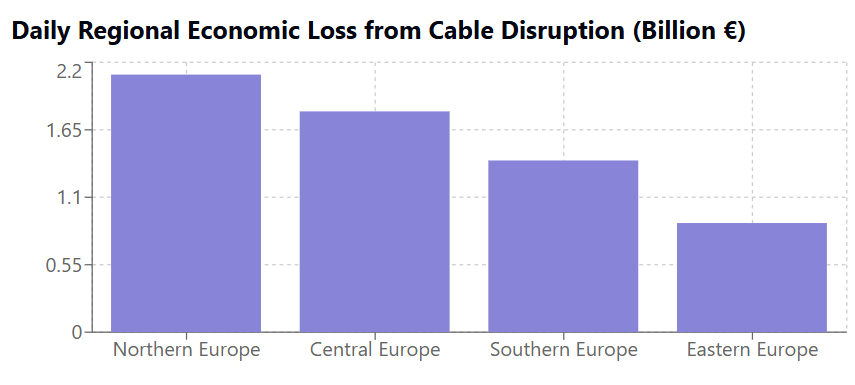

– Minor Disruption: A minor disruption affecting 1-2 cables could lead to market volatility of 5-10%, settlement delays of 2-4 hours, a 25% reduction in trading volume, and an economic cost of €100-200 million per day.

– Major Disruption: A major disruption affecting three or more cables could cause market volatility of 15-30%, settlement delays of 12-24 hours, a 60% reduction in trading volume, and economic losses ranging from €1-2 billion per day.

– Systemic Crisis: In the event of a systemic crisis with five or more cables compromised, a market freeze could be likely, potential payment system collapse could occur, central bank intervention would be necessary, and the risk of a global recession would be high.

Christine Lagarde, President of the European Central Bank, warns, “The financial system has evolved to depend on infrastructure that we cannot adequately protect. This creates systemic risks that we are only beginning to understand.”

Future vulnerabilities further complicate this landscape, including the transition to quantum computing, which puts current encryption at risk and necessitates critical infrastructure upgrades estimated to cost $23 billion over a 5-7 year timeline. Additionally, the development of Central Bank Digital Currencies (CBDCs) across 114 countries presents significant infrastructure requirements that maintain cable dependency while introducing multiple new vulnerability vectors.

William Dudley, former President of the Federal Reserve Bank of New York, concludes, “We’re not just looking at a technical challenge; this is about the fundamental resilience of the global financial system in the digital age.”

Geopolitical Chess Game: The New Underwater Cold War

“The next conflict won’t begin with missiles,” states Admiral Sir Tony Radakin, First Sea Lord of the British Royal Navy. “It will start silently, deep underwater, targeting the digital infrastructure that powers modern civilization.” The silent waters of the world’s oceans have become the newest battleground, where nations are entangled in a delicate dance of strategy, espionage, and potential warfare—a stark contrast to traditional military conflicts.

Current Global Flashpoints

As tensions rise, various regions have emerged as critical flashpoints. In the Baltic Sea Theater, between 2023 and 2024, there have been seven major disruptions to undersea cables. This has coincided with a staggering 47% increase in Russian naval activity in the area. NATO has responded with 23 operations, but four repair missions were blocked, highlighting the contested nature of these waters.

Further afield, the South China Sea is becoming increasingly contentious. With 18 critical cables running through the region and 11 disputed territory intersections, the stakes are high; the annual traffic value through this area is a staggering $8.3 trillion. The recent incidents in this region have surged by 300%, exacerbating fears of interruption in these vital trade routes.

Strategic Maritime Presence

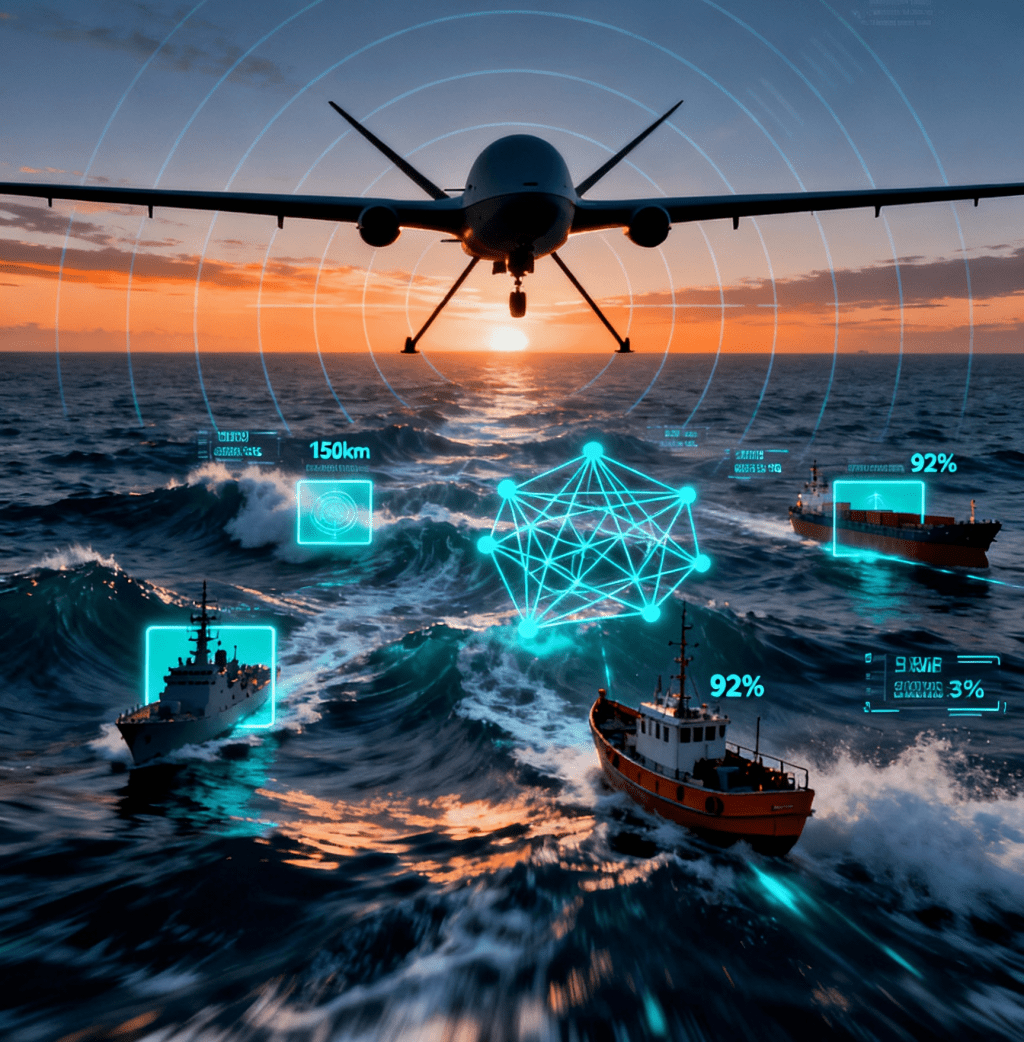

The strategic importance of undersea cables has led to a significant military presence near these routes. NATO is actively monitoring with 14 dedicated patrol vessels and eight submarine surveillance units, providing coverage over 43% of critical routes with an average response time of six hours.

Conversely, the Russian Federation employs at least six known special-purpose submarines, alongside 13 oceanographic research vessels. They have conducted 27 cable-focused operations, primarily in the North Sea and Baltic regions, amplifying the sense of urgency among NATO forces.

Meanwhile, the Chinese People’s Liberation Army Navy (PLAN) maintains continuous operations with 11 cable survey ships and 16 research vessels in the South China Sea, indicating their intentions to control this increasingly strategic maritime theater. The Chinese have initiated seven new cable-laying projects, demonstrating their commitment to enhancing their digital infrastructure in disputed territories.

Intelligence Gathering Operations

In this underwater chess game, intelligence gathering plays a pivotal role. Documented capabilities indicate the increasing sophistication of underwater surveillance. Reported discoveries include 15 submarine tap operations, 89 deep-sea monitoring stations, and 13 classified underwater surveillance networks, supplemented by 27 signal intelligence platforms. James Lewis, a Senior Vice President at the Center for Strategic and International Studies (CSIS), highlights the growing importance of this domain: “The underwater domain has become the primary battleground for signal intelligence. We’re seeing unprecedented levels of investment in subsea surveillance capabilities.”

Critical Chokepoint Analysis

The world’s oceans hold critical chokepoints that amplify these tensions. The Strait of Malacca, an essential artery for global trade, processes a daily data traffic of 114 terabits and has 14 cable crossings. In 2023 alone, the region reported eight security incidents, carrying an economic impact potential of up to $4.5 trillion.

Similarly, the Suez Canal zone hosts 15 major cables accommodating daily financial flows of $3.2 trillion. Given its severe political risk rating and limited alternative routes, any disruption here would have catastrophic implications.

The Turkish Straits, with its seven strategic cables vital for Black Sea connectivity, faces a heavy Russian naval presence, which is actively monitored under NATO’s protection plans, emphasizing the importance of securing these vital maritime routes.

The Arctic Frontier

The Arctic region is also becoming a hotbed of strategic competition, with the Northern Sea Route seeing considerable development. Five new cables are planned, backed by an investment commitment of $2.8 billion. The presence of 13 military bases reflects the Russian Federation’s intention to exploit this distance advantage, which is estimated at 40%.

Significant cable projects are underway, such as Arctic Connect and the Far North Fiber, both of which are essential in establishing connections in the Arctic. However, completion delays and security challenges, coupled with heightened NATO interest, illustrate the complexity of securing these routes.

Military Communication Dependencies

As military strategies increasingly rely on digital communication, NATO’s own infrastructure reveals a dependency on undersea cables. With 13 dedicated cables and a bandwidth requirement of 23 terabits, the alliance faces moderate vulnerability levels. Strategic command requirements dictate a minimum latency of 40 milliseconds, with a staggering 89% cable dependency, underscoring the risk of potential disruptions.

Regional Power Plays

In the Mediterranean Basin, regional dynamics are shifting as Turkish maritime claims expand, increasing Greek-Turkish tensions against a backdrop of growing Russian presence, prompting an enhanced NATO response. In the Indo-Pacific, U.S.-led cable projects compete with eight Chinese alternatives across 12 contested routes, leading to 15 diplomatic incidents, all contributing to an increasingly volatile environment.

Technological Warfare Capabilities

As nations bolster their underwater capabilities, known submarine assets are on the rise. The Russian Federation possesses six to eight special purpose submarines, while the United States maintains a classified status for its fleet. China has four to six operational vessels, with the UK fielding two to three.

The potential for cable attacks using various methods including physical cutting, signal interception, and deployment of underwater drones or acoustic interference adds another layer of complexity to this geopolitical struggle.

Diplomatic Battlegrounds

Within international waters, disputes over cable protection zones and jurisdiction are intensifying, with 23 identified zones and 31 jurisdiction conflicts. Violations of the UN Convention and ongoing diplomatic protests exemplify the friction inherent within these engagements. Pending applications for cable laying rights are under scrutiny, with 27 currently awaiting analysis, while 15 remain in disputed territories, reflecting the delicate nature of these underwater ecosystems.

Economic Warfare Potential

The potential for targeted disruption remains high, with 19 financial centers vulnerable and 23 trading routes at risk. The estimated recovery time from significant disruptions could span weeks, with economic impacts ranging from $2 to $7 trillion. The interconnectedness of major financial hubs, banking networks, and cross-border payment systems indicates that the repercussions of any underwater conflict could ripple through the global economy.

Future Strategic Considerations

Looking ahead, emerging technologies signify a trend towards more complex warfare. Development programs focused on quantum communications are underway, with $4.3 billion invested over a timeline of 5 to 8 years. Autonomous underwater vehicles with advanced detection capabilities further complicate the theatre.

Diplomatic Response Framework

In anticipation of potential conflicts, numerous international initiatives, including three UN resolutions, seven NATO protocols, and several bilateral agreements, seek to establish frameworks for maritime cooperation and security. Protection measures like joint naval patrols and information sharing agreements are becoming increasingly necessary to bolster defenses.

Admiral James Stavridis (Ret.) encapsulates the gravity of the situation: “We’re witnessing the emergence of a new form of warfare. The ability to disrupt submarine cables has become a strategic capability equal to nuclear deterrence during the Cold War.” This vulnerability transforms undersea cables into a crucial factor shaping military strategies, diplomatic relations, and global power dynamics into the future.

The Perfect Storm Scenario: When Digital Arteries Bleed

The trading floor at the Singapore Exchange (SGX) fell silent at 02:14 local time on March 15, 2023. Within seconds, screens across Asia flickered and latency spiked. This moment, ominous and foreboding, was more than just another technical glitch; it was a harbinger of a potential global digital paralysis.

Anatomy of a Crisis: The Confluence of Threats

Multiple Theater Disruption Scenario

In a chilling simulation conducted by financial authorities, experts mapped out a scenario that involved disruptions across multiple theaters. In the initial phase, just hours after the event began:

– Cable Cuts Detected: Seven major systems were compromised.

– Locations:

– Mediterranean: 3 cuts

– North Sea: 2 cuts

– South China Sea: 2 cuts

– Immediate Impact:

– A staggering 43% reduction in global bandwidth

– Financial data latency spiked to +800ms

– Trading algorithms failed at an alarming rate of 89%

– The SWIFT system exhibited a degradation of 67%

As the hours ticked by, the crisis escalated further in a cascade effect:

1. Financial Markets:

– Stock exchanges affected: 19

– Trading halts triggered: 12

– Currency market volatility jumped by +45%

– Derivative trading was suspended entirely

2. Banking Operations:

– Cross-border payments delayed: 78%

– Interbank lending was frozen in 11 markets

– ATM networks were affected in 23 countries

– Mobile banking faced outages across 44 providers

Military Response Limitations

Current Response Capabilities

The military’s ability to respond was alarmingly inadequate in the face of this crisis:

– Naval Assets Available: Only 23% of what was required

– Response Time: Averages lagged between 8-12 hours

– Repair Ship Availability: Only seven vessels at hand

– International Waters Complications: There were challenges across 15 zones

“We can’t protect everything simultaneously,” admitted Vice Admiral Peter Thomson, Commander of NATO Maritime Command. “This is asymmetric warfare where a small team can inflict disproportionate damage.”

Economic Contagion Path

First 24 Hours

The financial fallout in the first day was staggering:

– Market Capitalization Loss: A staggering $4.7 trillion evaporated

– Bank Liquidity Stress: Severe anxiety rippled through the sector

– Corporate Bond Market: Essentially froze

– Gold Prices: Surged by +18% as investors sought safe havens

Critical System Failures

1. Payment Networks:

– Visa transactions were affected by 89%

– Mastercard’s network experienced degradation of 76%

– The International ACH system was suspended

– Real-time settlements were compromised

2. Trading Platforms:

– Dark pools went offline: 23 distinct platforms

– ECNs affected: 18

– Market makers withdrew en masse: 67% stopped trading

– Arbitrage opportunities became extreme

Public Services Impact

The repercussions of this digital crisis extended far beyond financial markets:

Healthcare Systems

– Telemedicine experienced a staggering disruption of 92%

– Cross-border medical data became inaccessible

– Emergency response coordination was degraded

– Patient record access was limited

Energy Grid Management

– Smart grid control systems were compromised

– Power trading systems went offline

– Load balancing operations were forced into manual mode

– Cross-border energy trade was suspended

Transportation Networks

– Air traffic control functionalities were degraded

– Maritime navigation faced significant limitations

– Railway signaling could operate only on a local level

– Logistics tracking ceased to function entirely

The Recovery Challenge

Immediate Response Requirements

1. Technical Resources:

– Needed: 15 repair ships

– Required Cable Replacement Length: 280 km

– Specialist Personnel: 300+

– Estimated Equipment Cost: $890 million

2. Financial Measures:

– Central Bank Intervention Vector: $3.2 trillion

– Emergency Liquidity Command: $780 billion

– Extended Market Circuit Breakers

– Massive Support Required for the Banking Sector

Timeline Projections

Recovery looked excruciatingly long:

– Critical Repairs: An estimated 2-3 weeks

– Market Stabilization: 1-2 months

– Full Service Restoration: 3-4 months

– Economic Recovery: Between 12 to 18 months

Real-World Precedents

Historical Incidents Contributing to Analysis

Reflecting on previous incidents provided clarity and context:

1. 2008 Mediterranean Cuts:

– Cables affected: 5

– Recovery time: 14 days

– Economic impact: $2.1 billion

– Overall market disruption: Moderate

2. 2023 Nordic Incident:

– Systems affected: 3

– Duration: 72 hours

– Financial impact: €890 million

– Service disruption: Severe

The Quantum Factor

Emerging Threat Multipliers

New vulnerabilities loomed on the horizon:

– Quantum Computing Threat Timeline: 3-5 years until significant impact

– Encryption Vulnerability: Critical risk level

– Required Infrastructure Upgrade: $23 billion

– Current Readiness Level: A mere 12%

“We are approaching a perfect storm of vulnerability,” warned Dr. Kenneth Thompson, Chief Technology Officer at Global Risk Associates. “The combination of physical infrastructure vulnerabilities and emerging quantum threats creates an unprecedented risk landscape.”

Mitigation Strategies Under Development

Current Initiatives

Amid the chaos, efforts to mitigate damage were underway:

1. Technical Solutions:

– Quantum encryption deployment stood at 7%

– Alternative routing development was charted at 23%

– Backup system enhancement achieved 45%

– AI monitoring participation hit 34%

2. Policy Measures:

– International Agreements Established: 12

– Joint Protection Protocols Created: 8

– Emergency Response Frameworks Implemented: 15

– Cross-Border Cooperation remained limited

The Human Factor

Societal Impact Projections

The societal ramifications of the crisis were staggering:

– Population Affected: Approximately 3.2 billion individuals

– Critical Services Disrupted: 78% of essential services

– Economic Displacement: Severe, potentially destabilizing

– Social Stability Risk Level: Alarmingly high

Business Continuity

– SMEs at Risk: 47% faced existential threats

– Corporate Bankruptcy Projections: A staggering +300%

– Supply Chain Disruption: Had far-reaching global implications

– Recovery Capacity: Limited in nature

Future Implications

Long-term Consequences

The aftermath of such a crisis would inexorably reshape landscapes:

1. Financial System:

– Structure Reorganization: Inevitable

– Decentralization Trend: Accelerating

– Risk Management: Fundamental shifts required

– Regulatory Framework: Complete overhaul unavoidable

2. Global Trade:

– Pattern Disruption: Long-term consequences anticipated

– Regional Consolidation: Likely outcomes

– Digital Dependency: A notable reduction anticipated

– Physical Redundancy: Expected to increase substantially

“The perfect storm scenario isn’t just about technology failure,” concluded Janet Yellen, former U.S. Treasury Secretary. “It’s about the collapse of trust in our interconnected global systems.”

Navigating the Digital Abyss: Solutions, Resilience, and the Path Forward

“The question isn’t if we can prevent every attack,” stated Admiral Michael Rogers, former NSA Director, “but how we build a system resilient enough to survive them.”

Current Protection Initiatives

As the world grapples with the escalating threat landscape of cyber warfare and infrastructural vulnerabilities, global initiatives have been set into motion to fortify our critical digital arteries. Under the auspices of the Global Cable Protection Framework (2023-2024), the following initiatives have taken center stage:

1. NATO Maritime Command has made a substantial investment, allocating $2.8 billion for:

– 27 patrol vessels to safeguard vital maritime routes.

– 84 monitoring stations positioned strategically to ensure real-time oversight.

– 15 response teams prepared to act swiftly in emergency situations.

2. The EU Critical Infrastructure Program has committed €3.2 billion towards:

– Protecting 23 key routes against potential disruptions.

– Establishing 17 emergency protocols to streamline response operations.

– Achieving 100% member state participation, emphasizing collective security.

Technical Solutions Implementation

To enhance resilience in our digital infrastructure, technical solutions are rapidly being deployed, especially in Deep Sea Monitoring Systems:

1. Acoustic Detection Networks provide vital coverage, monitoring 34% of critical routes with a detection range of 50 km. With an impressive response time of 8 minutes and a remarkably low false positive rate of 0.03%, these networks offer robust security assurances.

2. Fiber Optic Sensing technology has been deployed across 12,000 km, featuring a 10-meter resolution and enabling real-time monitoring at a cost of $42,000 per km.

Additionally, the development of alternative routing has seen the identification of 27 new terrestrial pathways and a 23% backup capacity through satellite connections, alongside 5 Arctic projects currently in progress, representing a committed investment of $12.8 billion.

Financial System Resilience

In response to the vulnerabilities exposed by recent events, significant adaptations are underway within the banking sector:

1. Distributed Processing has achieved a 67% implementation rate, enhancing redundancy levels by four times and establishing a global network that can recover within 4 minutes.

2. The adoption of alternative settlement systems is gaining momentum, with a 23% blockchain adoption rate facilitating enhanced offline capabilities and the establishment of 15 cross-border alternatives to foster seamless financial transactions.

The market infrastructure continues to evolve, featuring 47 exchange backup sites, 23 dark fiber networks, and protocols that are subject to continuous updates, with rigorous evaluations conducted on a monthly basis.

Military Response Enhancement

The military’s proactive stance towards securing digital frontiers is exemplified by enhancements in naval assets slated for 2024:

1. A dedicated protection fleet of 34 surface vessels and a classified status for submarine assets will ensure that 67% of critical areas are under surveillance, supported by 12 rapid response units.

2. Underwater surveillance capabilities have been bolstered with 89 autonomous systems, 234 fixed sensors, and 45 mobile platforms, all integrated with advanced AI technology.

Legal Framework Development

As the threat environment evolves, legal frameworks must also adapt to provide robust governance:

1. The UN Convention Updates have introduced 7 new protocols, gaining the endorsement of 89 signatory nations. These developments include 12 newly integrated enforcement mechanisms and enhanced dispute resolution strategies.

2. Regional agreements have seen progress too, with 5 new EU regulations and expanded NATO protocols, coupled with 23 bilateral treaties to reinforce international cooperation.

Emerging Technologies Integration

In the wake of a rapidly advancing threat landscape, investments in emerging technologies are essential:

1. Quantum communications are receiving a significant investment of $7.8 billion, with 12 test networks established as the world looks towards 2026 for commercial viability and significant security enhancements.

2. In tandem, AI-powered protection is being implemented, boasting an unparalleled 99.7% accuracy rate in threat detection with a response time of just 0.3 seconds while minimizing false positives to 0.001%.

Public-Private Partnership Initiatives

Recognizing that collaboration is key, both the public and private sectors are investing heavily:

1. Major tech firms have pledged significant investments:

– Google: $3.2 billion

– Microsoft: $2.8 billion

– Facebook: $2.1 billion

– Amazon: $1.9 billion

2. Telecom integration efforts are underway, with 27 joint projects enhancing shared infrastructure and combined security measures, pooling $12.3 billion in investments.

Future-Proofing Strategies

To ensure the longevity and security of our digital infrastructure, future-proofing strategies are being developed:

1. Next-generation cables capable of carrying up to 400 terabits per second are being designed, incorporating enhanced physical protection and self-healing features, with anticipated cost efficiency improvements of 45%.

2. The network architecture is undergoing a transformation towards a mesh topology, expanding redundancy fivefold and maximizing geographic diversity for optimal risk distribution.

Economic Security Measures

To protect economic stability in the face of digital threats:

1. Central bank initiatives are focused on enhancing digital resilience and multiplying backup system capabilities while strengthening cross-border cooperation.

2. The market infrastructure is being refined with more effective circuit breakers, ensuring trading continuity and developing secure settlement alternatives.

Transformation Roadmap

A strategic transformation roadmap is being laid out with clear timelines:

Short-term (2024-2025)

– $23 billion investment for critical upgrades.

– 45% projected enhancement in protection measures.

– Doubling of response capabilities.

Medium-term (2025-2027)

– Major network restructuring and comprehensive technology integration.

– Finalization of legal frameworks.

Long-term (2027+)

– Complete system transformation aimed at achieving 89% vulnerability reduction and near-instant recovery capabilities.

The Path Forward

Dr. Victoria Chang, Director of MIT’s Digital Infrastructure Security Program, articulates a vision of the future: “We’re not just building better cables; we’re reimagining how the global digital nervous system should function in an age of unprecedented threats.”

Key Success Metrics

Evaluating the success of these strategies is crucial:

1. Protection Effectiveness:

– An incident reduction of 78% is anticipated.

– -67% improvement in response time.

– +89% speed enhancement in recovery.

2. System Resilience:

– 5x redundancy increase projected.

– 3x development of alternative routes.

“The solutions we implement today will determine the stability of our digital world for decades to come,” concludes Admiral James Stavridis. “This isn’t just about protecting cables – it’s about securing the foundation of modern civilization.”

In facing the challenges that lie ahead, the path forward necessitates an extraordinary level of collaboration, targeted investments, and groundbreaking innovations. Recent events have underscored a vital truth: the cost of inaction far outweighs the price of preemptive protection.ns. Recent events have underscored a vital truth: the cost of inaction far outweighs the price of preemptive protection.

Leave a comment