The maritime industry is currently experiencing considerable changes as it prepares for a series of new regulations that will come into effect by September 2025. These regulations, which cover areas such as safety, environmental sustainability, and operational efficiency, highlight the growing emphasis from the International Maritime Organization (IMO), the European Union (EU), and regional authorities on decarbonization, digitalization, and ethical practices. This article explores the implications, challenges, and strategic responses needed for compliance, providing stakeholders with a guide to successfully navigate this changing environment.

1. STCW – Electronic Certificates: A Digital Leap for Seafarer Credentials

Effective Date: January 1, 2025

The recent amendment to the Standards of Training, Certification, and Watchkeeping (STCW) Convention represents a significant move towards digitalization by allowing seafarers to use electronic certificates. These certificates are required to comply with IMO Circular MSC.1/Circ.1665, which mandates that they incorporate security features such as QR codes and cryptographic signatures to help prevent forgery.

Implications:

Efficiency Gains: Digital certificates make the verification process during port state controls much smoother, helping to cut down on administrative delays.

Cybersecurity Risks: This shift requires a strong IT infrastructure to protect against data breaches. For example, in 2023, a phishing attack exposed crew data for a major shipping line, highlighting existing vulnerabilities.

Industry Response:

Top registries, including the Marshall Islands and Singapore, have started testing blockchain-based platforms for issuing and verifying e-certificates. Training providers are also refreshing their courses to incorporate digital literacy modules.

2. IMSBC Code Amendments 07-23: Safeguarding Bulk Cargo Transport

Effective Date: January 1, 2025

Adopted through Resolution MSC.539(107), the amendments to the International Maritime Solid Bulk Cargoes (IMSBC) Code set forth stricter guidelines for cargoes that are susceptible to liquefaction (like nickel ore) and introduce new schedules for lithium batteries and hydrogen-based fuels.

Implications:

Safety Enhancements: The sinking of the Stellar Daisy in 2019, which was linked to cargo liquefaction, underscored the need for these updates.

Operational Adjustments: Shippers will need to perform advanced moisture tests and update their stowage plans accordingly.

Compliance Strategy:

Companies such as Cargill are investing in AI-driven cargo monitoring systems to anticipate instability risks in real time.

3. MARPOL Annex I – Red Sea and Gulf of Aden as Special Areas

Effective Date: January 1, 2025

The designation of the Red Sea and Gulf of Aden as Special Areas under MARPOL Annex I means that discharging oily mixtures is prohibited unless they have been treated through oil filtering equipment, adhering to a 15 ppm threshold.

Rationale:

These regions are ecologically sensitive, hosting coral reefs and endangered species, and have been affected by pollution from ongoing oil spills. A significant spill off the coast of Yemen in 2022 led to considerable damage to marine habitats.

Challenges:

– Retrofitting older ships with compliant separators could cost as much as $500,000 each.

– It is essential to train crews on the new discharge protocols.

4. EEDI Phase 3: Accelerating Decarbonization

Effective Date: January 1, 2025

The Energy Efficiency Design Index (EEDI) Phase 3 requires a 30% reduction in CO₂ emissions for new ships compared to a baseline set in 2013.

Technological Innovations:

– Wind-Assisted Propulsion: Companies such as Maersk and NYK Line are experimenting with rotor sails and kite systems.

– Hydrogen Fuel Cells: The Suiso Frontier, a carrier for liquid hydrogen, showcases this transition.

Economic Impact:

Although the initial costs are substantial, a study by DNV in 2024 estimated that adopting these technologies could save $9 million in fuel over ten years for each vessel.

5. FuelEU Maritime: EU’s Green Fuel Mandate

Effective Date: l January 1, 2025

FuelEU Maritime aims for a 2% reduction in greenhouse gas emissions by 2025 and applies to vessels over 5,000 GT operating in EU waters. Non-compliant ships will face penalties based on the excess CO₂-equivalent emissions.

Compliance Pathways:

– Biofuels: Trials by Hapag-Lloyd using bio-LNG have achieved a 22% reduction in emissions.

– Onshore Power Supply (OPS): Ports like Rotterdam are enhancing shore-side electricity availability to minimize the use of auxiliary engines.

Criticism:

Smaller operators contend that the regulation benefits larger companies with substantial research and development budgets.

6. Ballast Water Management (BWM) Record Book Reforms

Effective Dates: February 1, 2025

Introduction of a new record-keeping format.

October 1, 2025: Allowance for electronic record books.

Environmental Importance:

Ballast water can transfer invasive species, leading to economic losses of around $10 billion each year. The revised format aims to standardize entries regarding species, salinity, and treatment methods.

Digital Shift:

The My Ballast app from ABS allows for real-time logging, and the U.S. Coast Guard’s advisory in 2024 highlighted the importance of cybersecurity for electronic records.

7. Mediterranean ECA: Sulfur Cap Expansion

Effective Date: May 1, 2025

The Mediterranean will now be part of existing Emission Control Areas (ECAs), mandating that ships use fuel with a maximum of 0.1% sulfur or install scrubbers.

Economic Impact:

– Fuel prices could increase by 30% for vessels without scrubbers.

– Greek ferry operators are advocating for subsidies to help manage these costs.

Enforcement Issues:

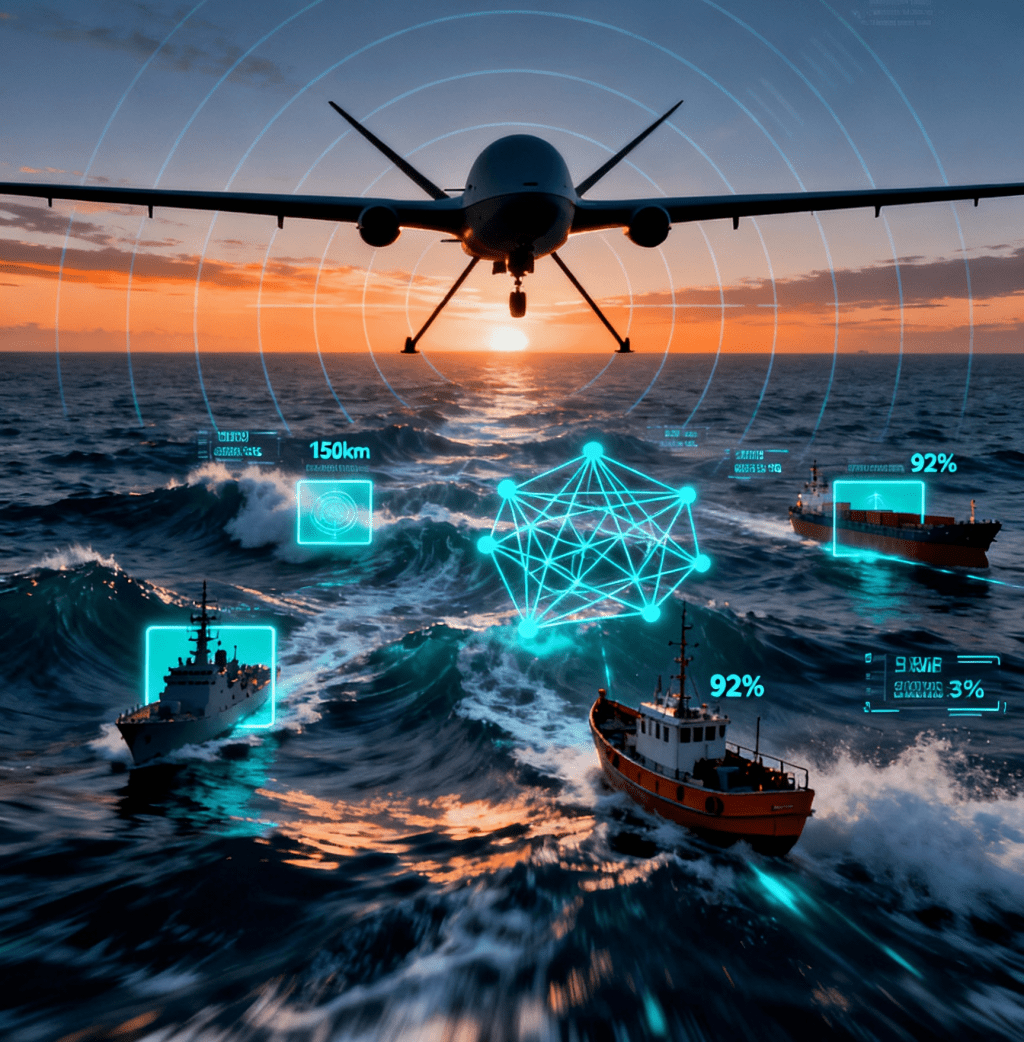

Compliance checks will be strengthened through satellite monitoring by EMSA and drone surveillance.

8. Hong Kong Convention: Ethical Ship Recycling

Effective Date: June 26, 2025

This convention requires an Inventory of Hazardous Materials (IHM) and aims to address the harmful “beaching” practices common in South Asian shipyards.

Advancements and Challenges:

– EU-approved recycling facilities in Turkey and China experienced a 40% increase in usage in 2024.

– NGOs are raising concerns about loopholes that allow ships flagged by non-parties to evade regulations.

Leave a comment