For centuries, the maritime industry has relied on skilled crews, paper logbooks, and manual navigation to move goods and people across the globe. Traditionally, decisions about routes, maintenance, and cargo have depended on experience and delayed feedback from ship to shore. However, a surge in digital transformation is changing these foundational practices.

Today, the adoption of the Internet of Things and Big Data platforms is redefining how the shipping world manages fleets, coordinates ports, and maintains equipment. Real-time data from ships, cargo, and coastal infrastructure now flows continuously to operations centers and cloud platforms, enabling a level of visibility and responsiveness that would have seemed impossible just a decade ago.

Artificial intelligence, instead of being the sole focus, is playing a supporting but vital role within this ecosystem. AI algorithms now work behind the scenes, analyzing sensor data, forecasting equipment failure, and automating decisions that enhance efficiency and reliability. This blend of IoT, Big Data, and embedded AI is setting new standards for operational excellence, regulatory compliance, and environmental stewardship.

Why it is required?

- The rapid digitization of fleet systems, cargo tracking, and port logistics means that shipping companies are adopting IoT sensors and platforms at unprecedented rates, with market size for maritime data solutions expected to reach $10 billion by 2025. This shift is not just about collecting more data, but about making faster, data-informed decisions that optimize routes, reduce fuel consumption, and anticipate maintenance needs.

- AI, while often spotlighted, truly unlocks the value of IoT-derived Big Data by enabling predictive analytics, anomaly detection, and automated responses, making shipping processes smarter and more resilient to disruptions.

AI as a Subset, Not the Headline

In this context, artificial intelligence acts like an analytical engine that sorts and interprets huge amounts of data generated by sensors. AI-driven algorithms help predict when machines might fail, optimize logistics, and assist with remote diagnostics. However, the basic technologies like IoT and Big Data platforms are essential for future maritime operations. A truly modern shipping operation relies on bringing these systems together, with AI as a key player in turning data into useful insights.

Current Market Trends and Data

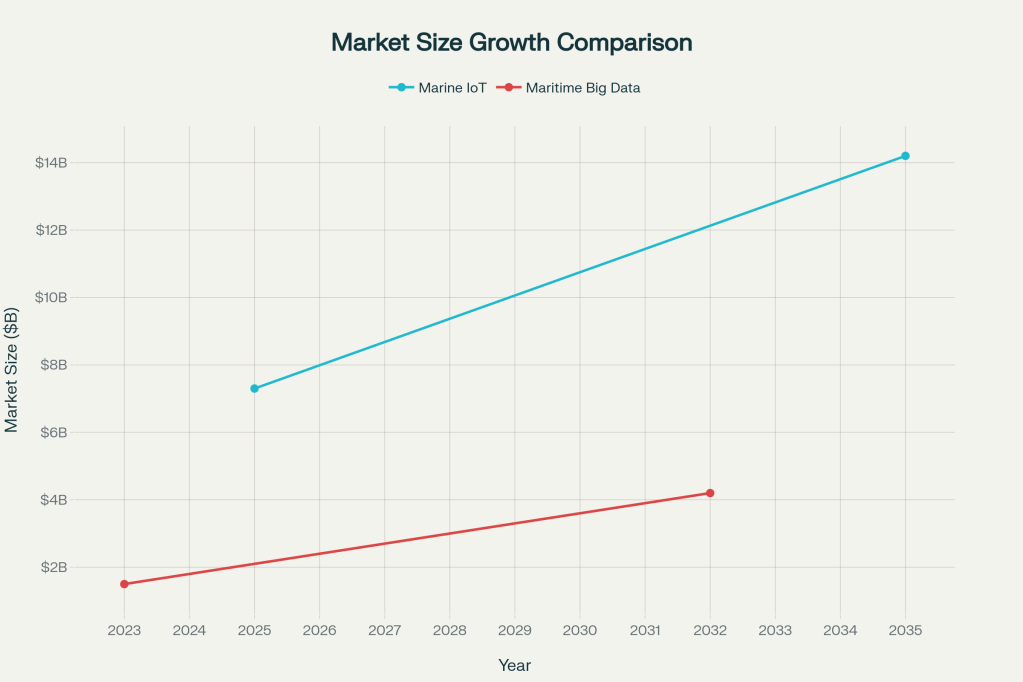

The maritime sector is experiencing a dramatic surge in the deployment of IoT sensors and Big Data platforms. In 2025, the global market size for marine IoT is valued at approximately $7.3 billion and is projected to reach $14.2 billion by 2035, expanding at a compound annual growth rate of nearly 8 percent. Big Data technologies, essential for aggregating and analyzing the enormous datasets generated by these sensors, are evolving just as quickly. The maritime Big Data market is expected to grow from about $1.5 billion in 2023 to $4.2 billion by 2032, showing a growth rate over 12 percent annually.

Asia-Pacific accounts for the largest share of maritime IoT adoption, driven by the presence of major port hubs, strong shipbuilding industries, and extended coastlines in need of robust monitoring solutions. Europe and North America are expanding rapidly thanks to substantial investments in port infrastructure and maritime security programs, which rely on real-time data for enhanced situational awareness and regulatory compliance.

Industry leaders, including Maersk, CMA CGM, Hapag-Lloyd, and MSC, are employing digital platforms that integrate IoT and Big Data analytics to automate vessel operations, track cargo precisely, optimize routes, and maintain equipment proactively. These initiatives set new standards for operational excellence and environmental sustainability.

Artificial intelligence plays a supporting but crucial role, enabling predictive analytics and automating insights drawn from sensor data across fleets and port assets. Together, IoT, Big Data, and AI are reshaping how shipping companies measure performance, manage resources, and comply with international safety and emissions regulations.

Key Applications and Industry Examples

Predictive Maintenance and Remote Monitoring

Leading maritime operators now use IoT sensors to continuously monitor engine temperature, vibrations, pressure, and environmental conditions. For example, Maersk outfits its fleet with IoT sensors that gather real-time performance data from propulsion systems, significantly reducing unexpected breakdowns and enabling more efficient maintenance schedules.

VoyageX AI’s Planned Maintenance System uses a blend of IoT and AI to detect anomalies, such as vibration patterns in a cooling system, allowing ship operators to intervene early and avoid expensive repairs for instance, a timely fix on a cargo vessel prevented a $50,000 loss due to proactive action. Rolls-Royce’s Intelligent Asset Management system harnesses sensor data for automated alerts and remote diagnostics, ensuring that repairs can be scheduled with minimal disruption to fleet operations.

Wärtsilä’s Fleet Operations Solution collects real-time data on engine performance and fuel consumption, providing actionable insights that have led to reductions of up to 30 percent in downtime for clients, boosting fleet efficiency and reliability.

Smart Ports and Supply Chain Optimization

Modern smart ports, such as the Port of Rotterdam and the Port of Singapore, have installed thousands of IoT sensors to monitor container locations, cargo conditions, vehicle movements, and water quality. These sensors support real-time visibility, improve resource allocation, and enable rapid response to potential disruptions whether environmental or logistical.

5G connectivity in smart ports enables ultra-fast data exchange and automation, supporting the deployment of autonomous vehicles and machinery, streamlining operations, and integrating environmental monitoring systems for compliance with international standards.

Data-Driven Decision Making and Sustainability

Several major shipping companies, including CMA CGM, Hapag-Lloyd, NYK Line, and MSC, have adopted advanced analytics platforms for fleet management, predictive maintenance, and real-time operational decision-making. These tools enable optimized routing, reduced fuel consumption, lower emissions, and enhanced security. Blockchain systems are also being implemented for supply chain transparency and secure documentation, minimizing fraud and speeding up compliance processes.

| Application | Industry Example(s) | Impact/Results |

|---|---|---|

| Predictive Maintenance | Maersk, Rolls-Royce, VoyageX AI, Wärtsilä | Reduced unplanned downtime by up to 30 percent, significant cost savings, remote diagnostics prevent major failures |

| Real-Time Fleet Monitoring | Maersk, MSC, NYK Line | Improved asset utilization, enhanced safety, faster decision-making |

| Smart Port Operations | Port of Rotterdam, Port of Singapore, Smart Ports (Qatar, MSC) | Real-time container tracking, optimized cargo flows, automated machinery, better resource allocation |

| Supply Chain Optimization | CMA CGM, Hapag-Lloyd | Optimized routing and scheduling, reduced fuel usage, lower emissions, enhanced compliance |

| Blockchain for Transparency | CMA CGM | Faster supply chain documentation, reduced fraud, streamlined regulatory procedures |

Predictive Analysis and Market Impact

The ongoing adoption of maritime IoT and Big Data platforms, powered by supporting AI, is forecast to fundamentally reshape fleet management, cost structures, and market behavior across shipping and port operations.

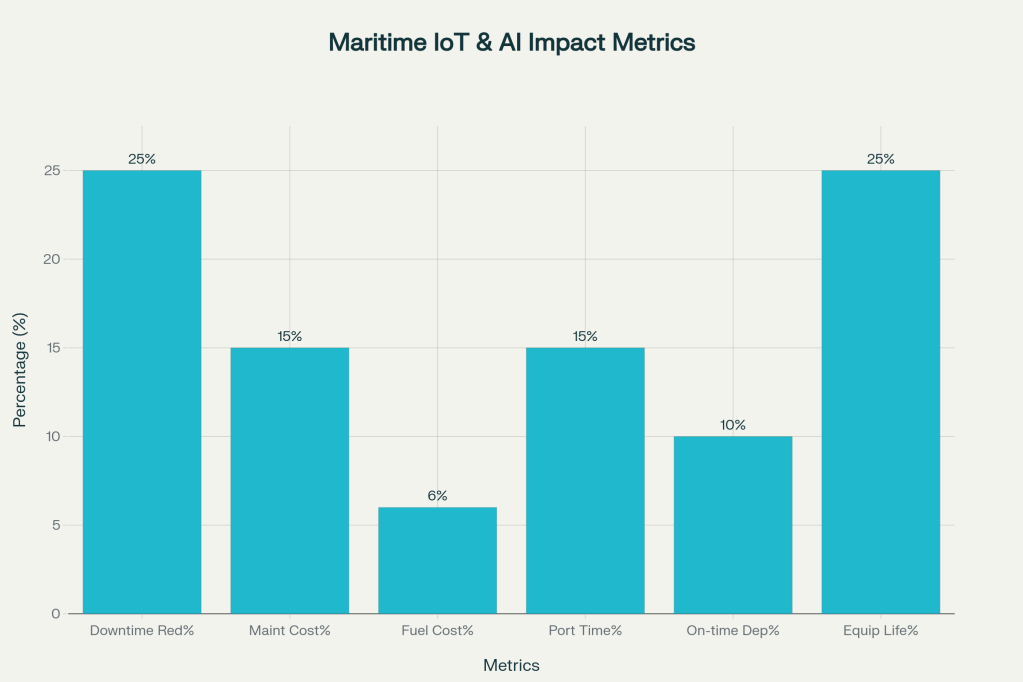

By 2030, it is projected that the proportion of global commercial fleets using predictive maintenance systems will double, resulting in a 25 to 40 percent decline in emergency breakdowns and related operational disruptions. These improvements not only lower direct maintenance costs but also minimize lost revenue from vessel downtime.

The spread of real-time monitoring and analytics can yield annual fuel cost savings of 5 to 7 percent for large operators, thanks to data-driven voyage optimization and improved engine performance. Smart port automation, enabled by IoT, also reduces container turnaround times by up to 15 percent and streamlines customs, cargo handling, and scheduling for thousands of daily operations.

As more companies integrate data across their fleets and supply chains, traditional market inefficiencies, such as opaque pricing, delays, and excess inventory are being reduced. Blockchain adoption is accelerating the speed and accuracy of documentation and compliance, potentially lowering fraud and disputes in global trade transactions.

However, true market transformation depends on overcoming persistent challenges. Data security, system interoperability, regulatory complexity, and high upfront costs remain barriers for widespread adoption, especially in smaller operators or developing regions. In this context, AI remains critical as a subset technology, automating anomaly detection and predictive analytics in increasingly complex operational environments.

If major regulatory changes or cybersecurity incidents occur, the overall pace of adoption could fluctuate, underscoring the industry’s need for robust, resilient digital architectures.

Business impact metrics of maritime IoT and AI adoption (key percentage improvements)

Challenges and Adoption Barriers

Despite the clear business case for maritime IoT, Big Data, and AI, several critical barriers stand in the way of full-scale adoption:

1. Data Security and Cyber Risk

With rising reliance on connected sensors and cloud platforms, ships and ports face growing threats from cyberattacks. Breaches could disrupt vessel navigation, cargo tracking, or port automation, leading to safety incidents and trade disruptions. Many operators cite cybersecurity as their top concern for IoT deployments in 2025, with market studies indicating over 60 percent of companies have faced attempted disruptions in the past two years.

2. Technology Integration and Interoperability

Integrating new digital solutions with legacy onboard systems and port infrastructure remains complex. IoT devices from different vendors often lack standardized interfaces, forcing companies to invest in custom middleware or face data silos that slow down analytics and decision-making. The lack of universal standards for maritime IoT hampers seamless data exchange across fleets and global supply chains.

3. High Upfront Costs and Uncertain ROI for Smaller Players

While large operators realize rapid returns, smaller shipping companies and developing ports face budget constraints for hardware, software, and skilled IT staff. Upfront investments in digital platforms, network upgrades, and cybersecurity protections can be prohibitive, delaying digital transformation especially in regions with slim profit margins or limited financing options.

4. Regulatory Complexity and Compliance

The rise of digital monitoring brings new regulations on data storage, privacy, emissions, and cybersecurity. Operators must track evolving requirements across multiple jurisdictions, which demands flexible, up-to-date compliance processes and further investment in legal and IT resources.

5. Workforce and Skills Gap

Many seafarers, port workers, and logistics teams require reskilling to work with sensor platforms, data dashboards, and automated maintenance systems. A shortage of maritime digital talent can slow adoption and limit the benefits of new technology, making training and recruitment a high priority for industry leaders.

6. Reliability and Data Quality

Maritime environments are harsh: saltwater, extreme temperatures, and vibration can degrade sensor equipment and connectivity, affecting the reliability of collected data. Poor-quality or incomplete data reduces the value of predictive analytics and increases the risk of costly operational errors.

Role of AI in Addressing Barriers

AI is increasingly used to enhance cybersecurity (detecting network anomalies), automate data cleansing, and support intelligent decision-making with limited or incomplete data. However, these solutions are only as effective as the foundational IoT and Big Data systems on which they depend.

Practical Strategies and Solutions

Industry leaders and forward-looking operators are overcoming adoption barriers and achieving measurable success by following systematic strategies:

1. Pilot Projects and Phased Rollout

Maersk began its digital transformation with focused pilots, first installing IoT sensors and predictive maintenance software on select container vessels. By meticulously tracking results, Maersk learned which data streams and analytics provided the best ROI, then scaled successful approaches fleet-wide. The Port of Singapore launched smart cargo tracking in a limited terminal zone, proving the concept before deploying sensors and analytics across its entire port infrastructure.

2. Vendor Selection and Partnership Models

Wärtsilä partners with shipping customers to supply integrated IoT sensor packages, cloud-based analytics platforms, and real-time fleet management dashboards. This full-stack approach reduces technology complexity for customers. The Port of Rotterdam teamed up with IBM to create a central data platform, streamlining secure data exchange between vessels, cargo handlers, and port authorities.

3. Cybersecurity by Design

MSC worked with cybersecurity firms to ensure every IoT device, network node, and cloud application deployed in their operations included end-to-end encryption and AI-backed intrusion detection. They perform regular cyber risk assessments and train their crews to identify and respond to digital threats.

4. Workforce Upskilling and Culture Building

Hapag-Lloyd conducts ongoing digital workshops and simulation training for crews and port staff. By focusing on building data literacy and familiarity with new dashboard tools, they ensure adoption is smooth and personnel can troubleshoot or optimize systems independently.

5. Incremental Technology Integration

NYK Line integrates new data analytics and sensor platforms through middleware that connects to legacy shipboard systems. This gradual upgrade reduces disruption and lets them maintain high reliability as older ships become smarter over time.

6. Continuous Measurement and Feedback

The Port of Los Angeles uses digital dashboards to monitor real-time cargo throughput, maintenance data, and emissions metrics. Leadership reviews these KPIs weekly, adjusting operations and investments based on up-to-date results.

7. Collaboration on Standards and Compliance

Industry groups like the International Association of Ports and Harbors (IAPH) bring together members including MSC, Maersk, and CMA CGM to develop common standards for IoT devices, data privacy, and emissions reporting. This coordinated effort helps everyone adapt to new regulations and ensures interoperability globally.

Conclusion and Recommendations

The rise of IoT, Big Data, and supporting AI technologies is fundamentally reshaping the maritime sector, moving it from manual, reactive practices to a data-driven, predictive model that delivers measurable gains in efficiency, safety, compliance, and sustainability. Early adopters like Maersk, Wärtsilä, MSC, NYK Line, and leading ports, including Rotterdam, Singapore, and Los Angeles demonstrate the advantages of targeted pilot projects, effective vendor partnerships, cybersecurity reinforcement, workforce upskilling, and incremental technology integration.

Operators who have implemented these strategies now report reduced vessel downtime, lower fuel and maintenance costs, faster port and cargo handling, and enhanced regulatory compliance. At the same time, many are overcoming persistent challenges security, integration, ROI by building resilient digital architectures and collaborating on industry-wide standards.

Recommendations for Next Steps

- Shipping companies and port authorities should prioritize small-scale pilots with clear business goals, then use their findings to shape larger digital investments.

- Selecting technology partners with proven maritime integration experience can streamline rollout and future-proof IT roadmaps.

- Embedding cybersecurity and workforce training from the start builds operational resilience and reduces long-term risks.

- Participation in global industry working groups accelerates the harmonization of standards and speeds up collective progress.

As IoT, Big Data, and AI become the new backbone of maritime operations, the leaders will be those who not only adopt technology but also cultivate a data-centric culture, bridging traditional maritime expertise with the power of real-time insight and automation.

Leave a comment